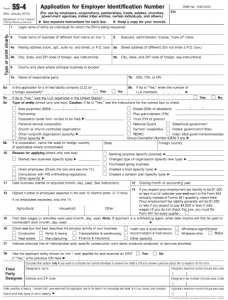

The next 2017 Employer Identification Number IRS SS4 Form, the 2017 SS4 Form will be released in January 2017 with regulations initially Made Effective May 21, 2012 in the IRS SS-4 Form read the quote below direct from the SS-4 Form:

to ensure fair and equitable treatment for all taxpayers, the Internal Revenue Service (IRS) will limit Employer Identification Number (EIN) issuance to one per responsible party per day. For trusts, the limitation is applied to the grantor, owner, or trustor. For estates, the limitation is applied to the decedent (decedent estate) or the debtor (bankruptcy estate). This limitation is applicable to all requests for EINs whether online or by phone, fax or mail. We apologize for any inconvenience this may cause.

2017 Employer Identification Number

Existing Footer SS-4 Content From Previous SS-4 Forms via 2017 Employer Identification Number:

- 1 For example, a sole proprietorship or self-employed farmer who establishes a qualified retirement plan, or is required to file excise, employment, alcohol, tobacco, or firearms returns, must have an EIN. A partnership, corporation, REMIC (real estate mortgage investment conduit), nonprofit organization (church, club, etc.), or farmers’ cooperative must use an EIN for any tax-related purpose even if the entity does not have employees.

- 2 However, do not apply for a new EIN if the existing entity only (a) changed its business name, (b) elected on Form 8832 to change the way it is taxed (or is covered by the default rules), or (c) terminated its partnership status because at least 50% of the total interests in partnership capital and profits were sold or exchanged within a 12- month period. The EIN of the terminated partnership should continue to be used. See Regulations section 301.6109-1(d)(2)(iii).

- 3 Do not use the EIN of the prior business unless you became the “owner” of a corporation by acquiring its stock.

- 4 However, grantor trusts that do not file using Optional Method 1 and IRA trusts that are required to file Form 990-T, Exempt Organization Business Income Tax Return, must have an EIN. For more information on grantor trusts, see the Instructions for Form 1041.

- 5 A plan administrator is the person or group of persons specified as the administrator by the instrument under which the plan is operated.

- 6 Entities applying to be a Qualified Intermediary (QI) need a QI-EIN even if they already have an EIN. See Rev. Proc. 2000-12.

- 7 See also Household employer on page 4 of the instructions. Note. State or local agencies may need an EIN for other reasons, for example, hired employees.

- 8 See Disregarded entities on page 4 of the instructions for details on completing Form SS-4 for an LLC.

- 9 An existing corporation that is electing or revoking S corporation status should use its previously-assigned EIN.